Not a day goes by without more news about the ongoing conflict in the Ukraine, the ramifications of which will be felt across supply chains for months if not years to come. The impact will be direct and indirect relating to commodities and energy. Russia and Ukraine account for 29% of all the world's wheat exports, and Germany relies on Russian gas to power its electricity and energy grid by around 50%. The pursuit of billionaires in the Navalny 35 continues with the French seizing €850 million in a single day. Coordinated sanctions by many world governments are changing the dynamics of supply chains globally.

More than 400 companies globally have put distance between themselves and Russia according to research compiled and published by Yale School of Management. Yale has defined 5 categories of companies as follows:

-

WITHDRAWAL - Companies making a clean break and completely exiting Russia and halting all Russian engagements.

-

SUSPENSION - Companies temporarily curtailing operations while keeping return options open for return.

-

SCALING BACK - Companies reducing activities and scaling back some business operations while continuing others.

-

BUYING TIME - Companies holding off on new investments or developments and postponing future planned investments/developments/marketing while continuing substantive business.

-

DIGGING IN - Companies defying demands for exit or reduction of activities.

All this shows that the response has not been universal and different organizations will have different or competing motives for their actions. Procurement and supply chain leaders’ alignment with their organization’s strategy will be key in this area. However, it will need careful consideration in terms of immediate, short, and long term reputational consideration. This is both internal and external with some employees already posting comments about many companies via Glassdoor and their positions on their employers' responses.

Below is a perspective on the situation from the FTSE100 as of 21st March 2022:

Image credit: Torsten Asmus via Getty Images

London Stock Exchange

The London Stock Exchange has suspended trading in 28 companies to date with strong links to Russia, with more being investigated with secondary links. Some of the most notable are; Lukoil, Gazprom, EN+, and Rosneft, Russian bank Sberbank, Novolipetsk Steel, and Polyus, VTB Capital, a subsidiary of Russia’s second-largest bank VTB. This also extends to pension funds, securities and other investment vehicles.

BP

After spending 30 years building up its business, it took BP’s board just three days to accept a potential $25 billion loss by selling its stake in Rosneft, Russia’s state-owned gas company. BP battled with Putin’s corrupt oligarchy for years until it came to a working arms-length relationship. But the speed of withdrawal meant that even with that relationship, BP had a rapid exit strategy in place.

Renault

In contrast, car-maker Renault relies on the Russian market for 12% of its revenue through its majority stake in AvtoVAZ, which is both the largest car manufacturer in Russia and a partnership with the Russian state manufacturer of missiles, planes, and AK-47s, itself the subject of Western sanctions since 2014. The business partnership makes it expensive to pull out of the Russian economy and the loss of 37% of its value since the Russian invasion makes it expensive to stay. Renault is deeply enmeshed with actors in Putin’s war machine, and although it has paused some of its operations because of logistics problems caused by the sanctions, Renault appears to have had no real exit strategy or to have planned for such tough sanctions.

According to CNBC the downstream impacts could be summarized as follows:

-

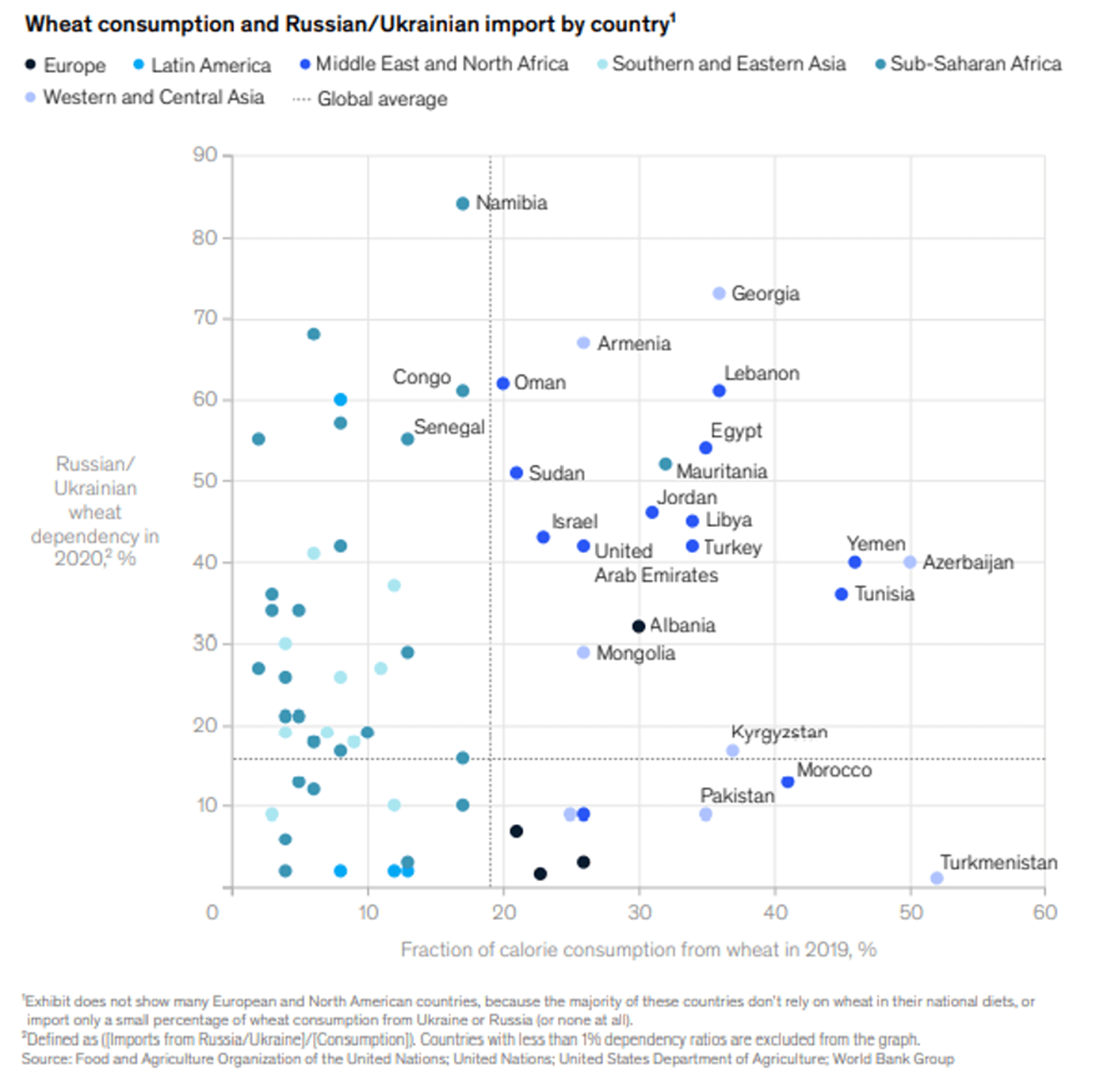

Russia & Ukraine account for 29% of the worlds wheat exports.

-

Ukraine has replaced the U.S. as China’s top corn supplier in 2021

-

Russia and Ukraine are large suppliers of metals and other commodities.

-

Germany, along with the EU would be especially hit, especially in terms of energy supplies. Further, exports from Germany include autos and auto parts, other transport equipment, electronics, metals and plastics.

-

Oil and Gas prices are set to surge even further gas prices, but the impact on energy won’t be the only ramification.

-

Ukraine produces wheat, barley and rye that much of Europe & MENA relies upon, with a prolonged conflict likely to create bread shortages.

-

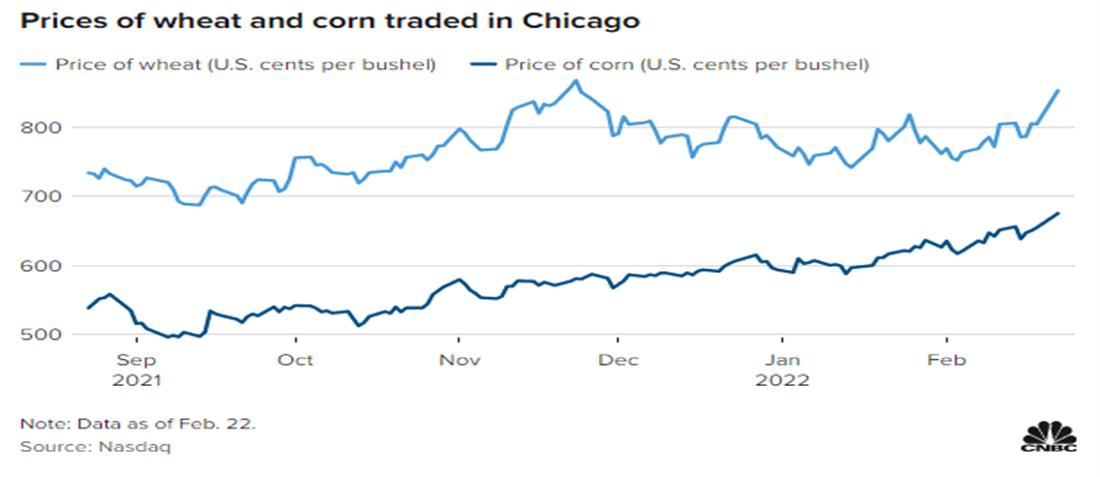

Wheat futures traded in Chicago have jumped about 12% since the start of this year, while corn futures spiked 14.5% in the same period.

-

Production of energy-intensive products such as fertilizers are likely to be short supply: Fertilizers were already in short supply last year, leading to soaring prices.

-

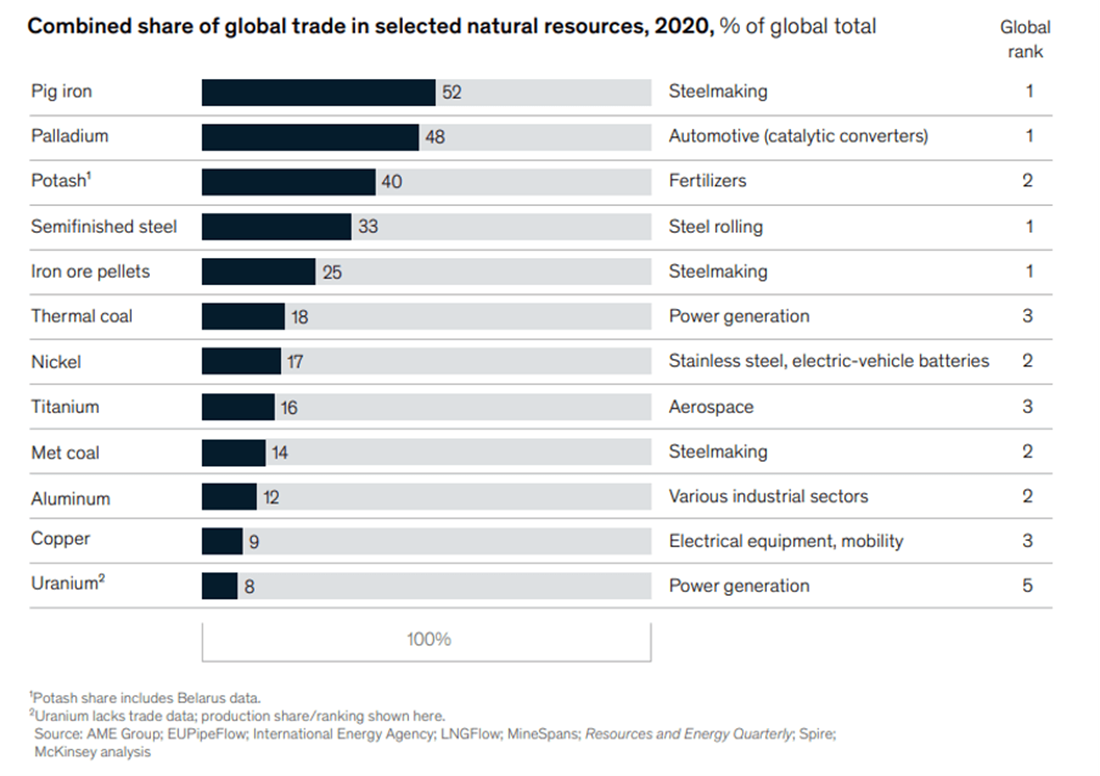

Russia controls about 10% of global copper reserves, and is a major producer of nickel (key raw material in batteries) and platinum.

-

The U.S. chip industry heavily relies on Ukrainian-sourced neon and Russia also exports a number of elements critical to the manufacturing of semiconductors, jet engines, automobiles and medicine.

Nickel

According to a variety of sources such as The Register, The Wall Street Journal, and Tech Crunch, the impacts across the supply chain will not only on price, but security of supply and regular flow of materials, all of which will have cash flow implications. For example, Nickel is a major component of the high nickel chemistry batteries (NCM 6, 7 and 8 series, NCA etc.) which is predominantly used in the U.S. and Europe. This could lead to stockpiling and serious price escalations as manufacturers struggle to keep production moving when you consider that Russia ranks third globally in terms of nickel production and, therefore, constrained nickel supplies is likely to slow down EV battery production.

Automotive Manufacturers

To compound the issue for automotive manufacturers (81% of total consumption) in particular, Russia is one of the largest producers of Palladium, accounting for around 35% of the global palladium production. Nornickel the largest palladium producing company located in Russia. Palladium prices have jumped by 37% since the start of year 2022, with likely increases and price volatility.

Sunflower Oil

Ukraine is the largest producer and exporter of sunflower oil accounting for 33% of global production and 50% of global exports. Export prices from the country reached $1550/MT on 24th February (+7% on the prior week). Since the start of conflict in February India has not received a single shipment of sunflower oil from Ukraine against an average import of 200,000 MT from the country per month. Further, a Cargill-chartered vessel was hit by a projectile in the Black Sea on 24th February who owns a majority stake in a deep-sea port near Odessa, Ukraine. Clearly cutting ties and stopping business for these types of operations is hugely complex.

Other Geopolitical Issues

What we should also not lose sight of is the fact that on the commencement of the Ukraine invasion, China immediately conducted air raids over Taiwan. Further heightening the geopolitical stability. However, the exposure to sanctions and trading is significantly lower in the Latin American countries due to pre-existing links and the fact that NATO is not connected with this region.

Ports

Lloyds Market Association has placed Ukrainian and Russian waters in the Black Sea and the Sea of Azov under a high-risk category with a full blockade of the ports in the Black sea expected. This has inevitably pushed up the insurance premiums for freight, further escalating the freight charges.There are currently a number of closed or restricted sea ports and airports:

-

Ports on the sea of Azov, include Taganrog, Mariupol, Yeysk and Berdyansk.

-

Federal Agency for Air Transport has closed airports in Russia, these closures are currently in force and under review.

-

The closures include airports in Rostov, Krasnodar, Anapa, Gelendzhik, Elista, Stavropol, Belgorod, Bryansk, Kursk, Voronezh, and Simferopol.

IT Exports

Ukraine’s IT export portfolio has increased by 36% to $6.8 billion in 2021, up from $5 billion in 2020 and $4.2 billion in 2019, according to the IT Ukraine Association. It is estimated that there are over 100,000 IT employees in software engineering and other IT services, with overall IT resources around 285,000 in Ukraine. The companies currently known to be associated/impacted are larger IT Service providers (EPAM, Intellias, Ciklum, ELEKS etc.) and IT centers of global Tech firms such as Google, Uber, Facebook.

Australia

On March 21, 2022, the Australian Prime Minister, Scott Morrison said they are making $243m on a critical minerals project to boost supply chain resiliency in an attempt to reduce the country’s reliance on China. This investment is set to create over 3,400 jobs and establish Australia’s place in the fast-growing critical minerals, electric vehicle, and battery markets as a result. However, this will take time to materialize like most capital investments and will not alleviate the immediate situation.

The Future

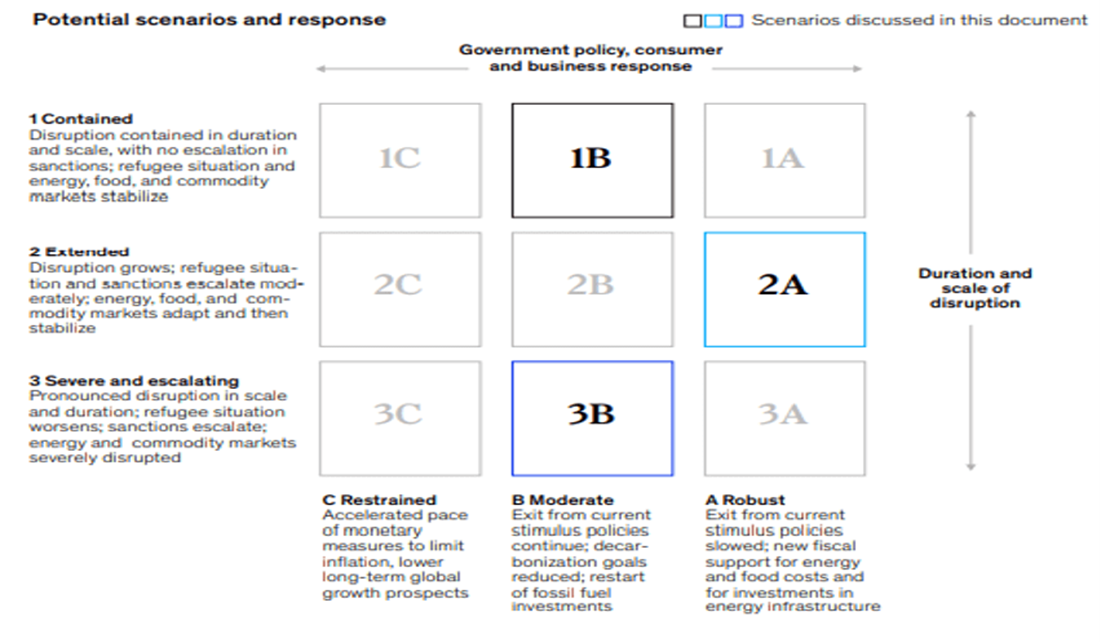

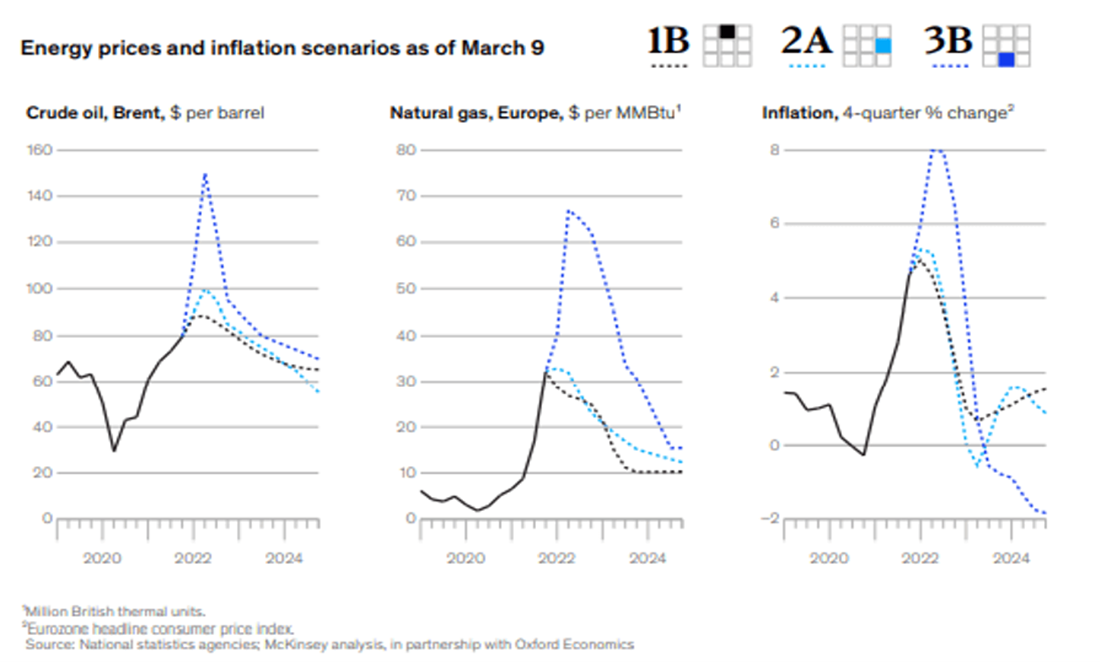

Looking at this from an economics and future perspective, as everyone would like a crystal ball at this moment in time, McKinsey’s recent paper (see resources below) in March 2022 set out three scenarios from the point of two critical dimensions:

- Scale and duration of the disruption

- The impact of government policy, consumer, and business responses.

This is illustrated in the diagram below:

This analysis then leads to how the economists think the energy prices and inflation are likely to play out in each of these 3 scenarios:

Additional Read: Geopolitical Insights of Ukraine Russia Conflict on Supply Chains (Part 2)

The list of companies defined by the Yale School of Management has grown from 400 to more than 1,200 counting. Almost 1,000 companies have publicly announced they are voluntarily curtailing operations in Russia beyond the bare minimum legally required by international sanctions, but some companies have continued to operate in Russia undeterred.

See below for a summary of company positions as of today:

-

WITHDRAWAL (Grade A) - 334 companies

-

SUSPENSION Grade B) - 455 companies

-

SCALING BACK (Grade C) - 152 companies

-

BUYING TIME (Grade D) - 160 companies

-

DIGGING IN (Grade E) - 244 companies

A full list can be accessed by following this link: Almost 1,000 Companies Have Curtailed Operations in Russia—But Some Remain | Yale School of Management

Perhaps some of the more notable/well known Remainers (Group F) are: Alibaba, Ariston Group, Aveya, Braun, Calzedonia, Check point software (counter cyber security), Etam, Giorgio Armani, Koch Industries, Makita, Mitsubishi, OBO Bettermann, Raiffeisen Bank International, Syngenta, Vaillant Group, so or all of which will undoubtedly struggle to comply with new legislation fully now and in the future.

Original classification form Yale School of Management:

- WITHDRAWAL - Clean Break: companies completely halting Russian engagements/exiting Russia;

- SUSPENSION - Keeping Options Open for Return: companies temporarily curtailing operations while keeping return options open;

- SCALING BACK - Reducing Activities: companies scaling back some business operations while continuing others;

- BUYING TIME - Holding Off New Investments/Developments: companies postponing future planned investment/development/marketing while continuing substantive business;

- DIGGING IN - Defying Demands for Exit: companies defying demands for exit/reduction of activities

The response has not been universal and different organizations will have different or competing motives for their actions. For procurement and supply leaders’, alignment with your organization’s strategy will continue be key in this area. However, this may test certain employee positions as the company strategy and personal codes may not be fully aligned. Time will of course be a key arbiter in this space.

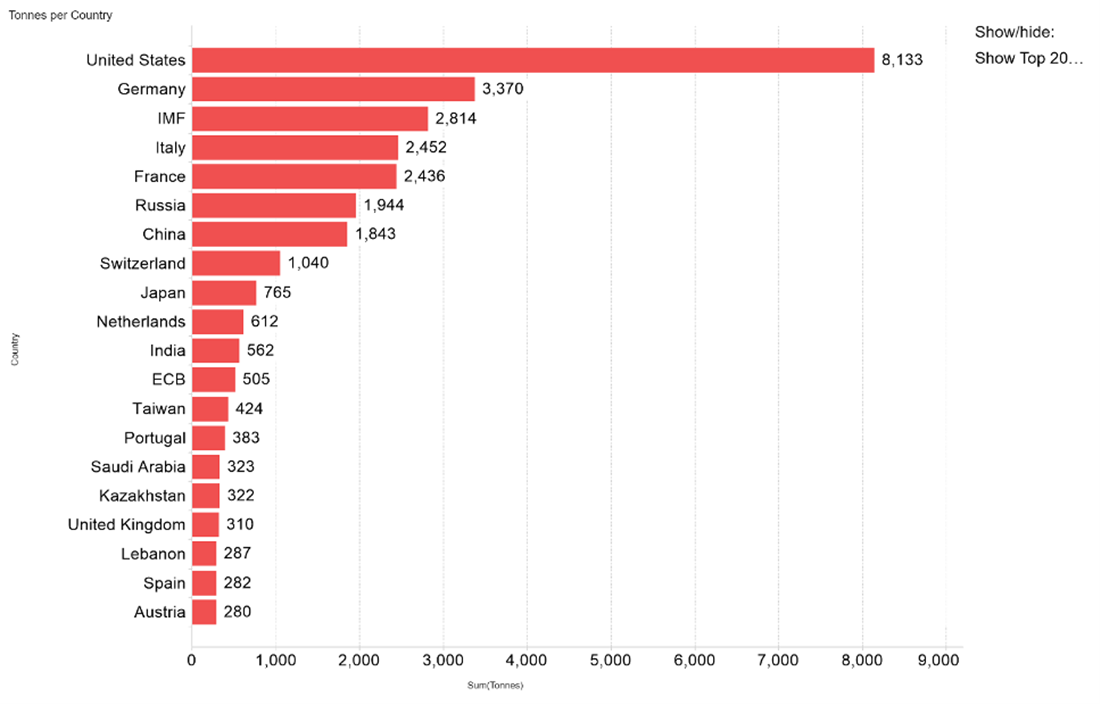

Monetary sanctions and counter measures continue to be debated with a variety of views and commentary being offered. The outcome of this means that for each entity they must carry out due diligence salient to them and their supply chains in order to be able to make effective decisions both now and in the future. Some points to consider will be that since the end of WWII, the US dollar has been used as the world’s reserve currency, accounting for about half of all global trades, loans and debt, helping to anchor the international monetary system. Other stable currencies such as the Swiss Franc. British pound and more recently the Australian dollar have also been used in the same way. However, this war in particular could spell the end of the US dollar and other stable currencies use and see the emergence of gold as a new common fiscal anchor. As can be seen from the table below there is a wide contract in the top 20 countries:

Source: www.suissegold.eu

Russia’s invasion in Ukraine has caused precious metals prices to jump as supply remains low, consistent supply is uncertain and therefore demand continues to grow stronger. Specifically, Russia supplies 15% of the world’s platinum, has a 40% share of the world’s palladium, (which makes it the world’s largest producer), and is the second largest gold producer. Further, the sanctions imposed on Russia along with its removal from the SWIFT Banking system will also provide large obstacles to export its precious metals, consequently increasing their value as demand grows.

The automobile industry is increasing its production in 2022 as the global semiconductor supply chain crisis eases. This production is driving demand for precious metals like platinum, palladium, and rhodium. These industrial metals are key components of autocatalytic converts; technology used to lower emissions. Rhodium alone has recorded a 67.52% increase in its value since the start of 2022. Palladium has increased 34.60% this year and is expected to continue if supply decreases and demand increases.

Conversely though Lithium, another natural earth rare metal is produced outside of the Ukraine & Russia currently. However, there is rapidly increasing demand and therefore supply will be an issue. For context in 2020, lithium production was slightly above 0.41 million metric tons of LCE; in 2021, production exceeded 0.54 million metric tons (a 32% Y-on-Y increase). Sources suggest that lithium demand of 3.3 million metric tons or a compounded 25% growth rate. Interestingly, most of the current sources of lithium comes from Australia, Latin America, and China (accounting for a combined 98% on a 2020 baseline). An announced pipeline of projects will likely introduce new players and geographies to the lithium-mining map, including Western and Eastern Europe, Russia, and other members of the Commonwealth of Independent States (CIS). This reported capacity base should be enough for supply to grow at a 20 percent annual rate to reach over 2.7 million metric tons of LCE by 2030.

Another key metal to look towards is palladium with Russia being the largest producer, it is evident that these sanctions will heavily affect palladium’s value. While exports might drop due to the sanctions, the supply shortage is expected to boost prices.

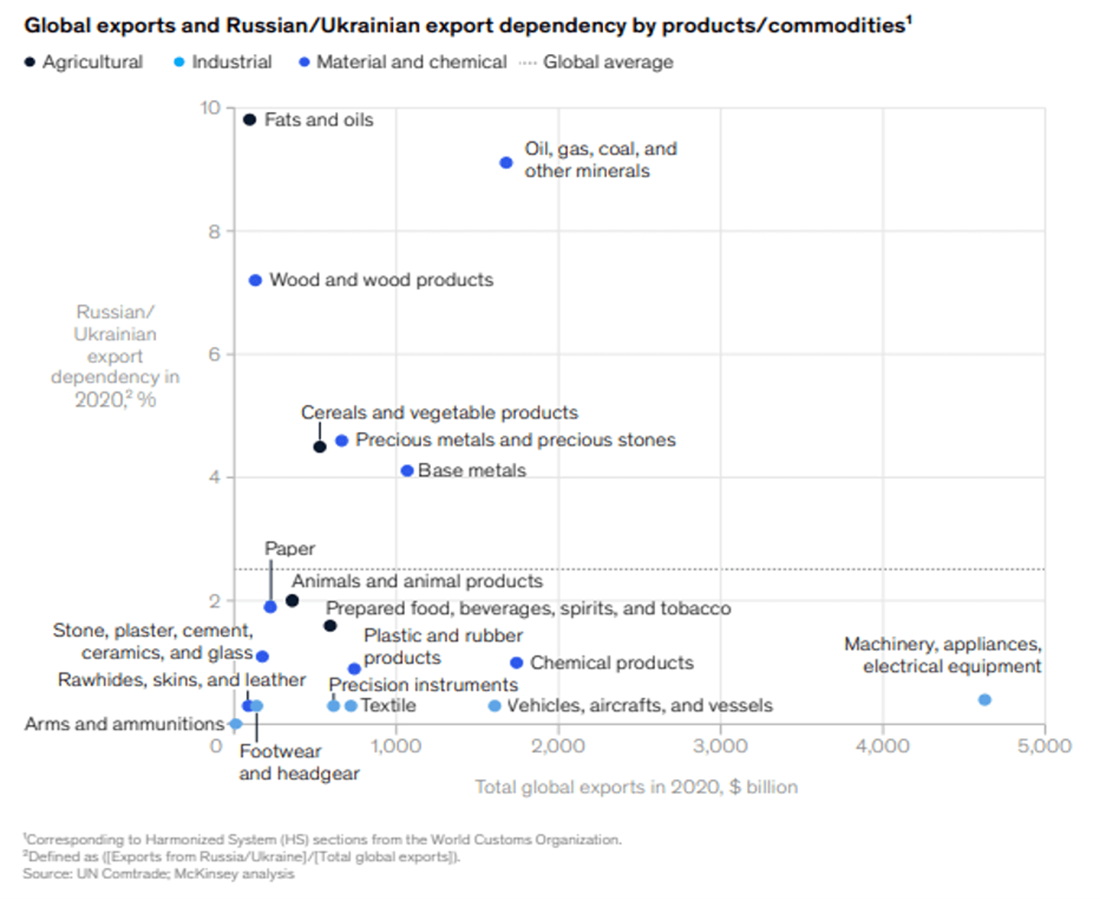

As reported before there are other areas that are critical to global supply chains such as wheat, fertilizers, sunflower oil, corn, etc all of which will undoubtedly support the analysis and commentary in relation to food supply chain shortages in the months to come. A recent illustration by McKinsey (May 2022) illustrated it a shown below:

This is exacerbated by other factors such as the Indian government declaring that it will not allow exports of wheat and other substantive food products, only those that are supported by pre-existing foreign exchange notes prior to the declared export ban. However, the primary countries to eb impacted by the primary food crops will be the Middle East, North Africa, Western and Central Asia, as illustrated in the chart below, also by McKinsey (May 2022).

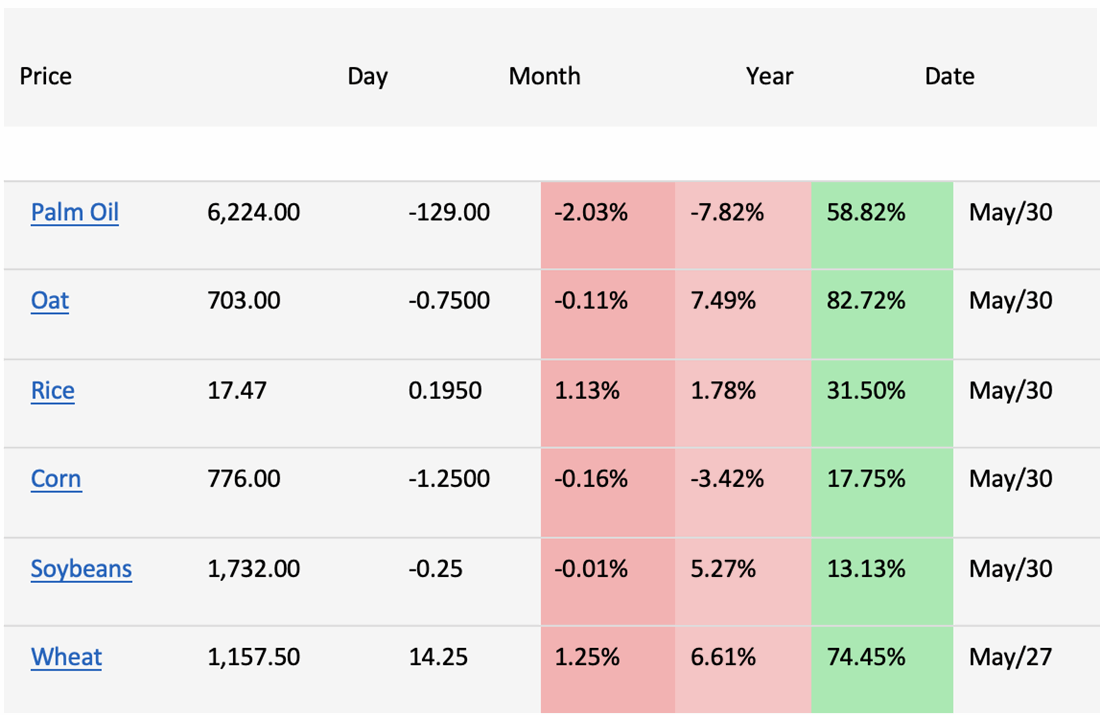

Looking across the food commodities in particular, whist there have been some minor changes and easing the overall picture shows growing and future increases, supporting the issues raised regarding a food supply issue to come.

Source: https://tradingeconomics.com/commodity

Turning to the essential aspect of energy we can see that there are many issues from currency, supply links to high dependency countries from Russia, such as Germany and Hungary, etc. However, in the wake of this the pursuit of ESG strategies and in particular the net-zero commitments will be put under strain as a consequence. In particular three factors as impediments to key instruments such as the interruption of supply of key materials, products and services from the Ukraine, economic sanctions against Russia, and reduced economic cooperation between nations. In the context of energy, a report by Pippa Stevens stated, “since the war began a substantial influx of capital into renewable energy funds has taken place, reversing a multi-month downward trend”. A clear signal that companies are taking alternative approaches and so it could be argued the war has acted as catalyst for good. However, complexity, challenges and indeed the very access to rare earth metals will all have a bearing on this.

There are a number of positive investments into the start-up community, which are being supported by groups such as the NetZero Technology Centre ( Net Zero Technology Centre (netzerotc.com) anchored in Aberdeen, Scotland, who I have had the pleasure of collaborating with. However, a key topic of debate is and will continue to be, amongst many others, the supply chains they will be able to construct and lean into to drive availability of the products that feed into the likes of wind turbines, energy saving technology, solar and alternative energy generation, etc. Therefore, we should note the Ukraine and Russia both have a significant share of global trade in many commodities, as mapped by McKinsey:

In terms of impacted sectors, we can again see that whilst manufacturing is an obvious candidate those also under pressure will be:

- Aerospace & Defense

- Automotive

- Consumer products (white goods, durables, etc.)

- Energy producers (both current and alternative)

- Construction & Property

- Technology

- Logistics and freighting

- Farming/agriculture (seeds, fertilizers, and machinery)

This current and ongoing fragility will undermine economic recovery in many and diverse direct and indirect ways and is unlikely to be short term.

According to the Aljazeera news bulletin (25th May 2022) Time is running out to export some 24 million tonnes of grain stuck in grain silos, out of Ukraine before the country’s new harvest as Russian forces continue to blockade the country’s Black Sea ports. Further, there is now no room to store the country’s next grain harvest in existing viable grain silos or those that have been damaged in the war. According to Ukrainian lawmaker Yevheniia Kravchuk at the Davos summit last week the Ukraine has about a month and a half before farmers start to collect the new harvest.

The issue from a logistics point of view is the ports of Odesa, Chornomorske and others cut off from the world by Russian warships and the grain supply can only travel on Ukraine’s congested land routes that are far less efficient and/or safe. During the discussions at Davos, but independent of them via The Interfax news agency earlier cited Russian Deputy Foreign Minister Andrei Rudenko as saying Moscow is ready to provide a humanitarian corridor for vessels carrying food to leave Ukraine, in return for the lifting of some sanctions. European Commission Chief Ursula von der Leyen on Tuesday (24th May 2022) called for talks with Moscow on unlocking wheat exports trapped in Ukraine by the sea blockade.

Additional Read: Geopolitical Insights of Ukraine Russia Conflict on Supply Chains (Part1)

Resources

Stevens, P., Lithium’s vital role in the energy transition sends prices to record highs. How to play it. 15/05/22

Crispeels, P., Robertson, P., Somers, K., and Wiebes, K., Outsprinting the energy crisis. May 2022

Olivia White, Kevin Buehler, Sven Smit, Ezra Greenberg, Mihir Mysore, Ritesh Jain, Martin Hirt, Arvind Govindarajan, and Eric Chewning. War in Ukraine: Twelve disruptions changing the world. May 2022

Russian and Ukraine commodities review: base metals (https://country.eiu.com/Ukraine/ArticleList/Analysis/

Simchi-Levi, D., and Haren, P., How the war in the Ukraine is further disrupting global supply chains, March 2022

John E. Katsos, Jason Miklian, and John J. Forrer. In Light of Russia Sanctions, Consider Your Conditions for Doing Business in Other Countries. 15th March 2022

Yale School of Management: Almost 1,000 Companies Have Curtailed Operations in Russia—But Some Remain | Yale School of Management

Gold reserves by country: www.suissegold.eu

Commodity prices: https://tradingeconomics.com/commodity

Resources

Russian asset tracker, The Navalny list of 35 individuals named last year by the jailed opposition leader Alexei Navalny (Guardian consortium with cross media investigative journalist group 7 support from the SFO) Russian Asset Tracker - OCCRP

Management today: https://www.managementtoday.co.uk/does-ftse-100-stand-russia/down-to-business/article/1750144

HBR: Are the Risks of Global Supply Chains Starting to Outweigh the Rewards? (hbr.org)

How the War in Ukraine Is Further Disrupting Global Supply Chains (hbr.org)

McKinsey: war-in-ukraine-lives-and-livelihoods-lost-and-disrupted.pdf (mckinsey.com)

When nothing is normal: Managing in extreme uncertainty (mckinsey.com)

in-conversation-managing-in-extreme-uncertainty.pdf (mckinsey.com)

Six problem-solving mindsets for very uncertain times (mckinsey.com)

building-value-chain-resilience-with-ai.pdf (mckinsey.com)

the-resilience-imperative-succeeding-in-uncertain-times.pdf (mckinsey.com)