ESG is an acronym for Environmental, Social, and Governance as it pertains to how businesses are evaluated based on their impact on society. It is related to the way businesses operate in their approach to environmental sustainability, and it is a critical dimension for measuring a company’s health, performance, and long-term competitiveness beyond immediate profitability.

ESG is more than ticking boxes. It’s about making a difference in your business by creating sustainable outcomes that drive value and fuel growth. Investors, consumers, and regulators are demanding proactive, community-level commitments and accountability in supply chain sustainability to operate as harm-free businesses beyond shareholder wealth.

Environmental

What is the impact of your business operations on the natural world? How are the environmental risks and compliance addressed? The Environmental pillar considers factors such as carbon emissions, water and waste management, raw material sourcing, and climate change.

Social

What is the impact of your business operations on society? How are stakeholder needs and interests met? The Social pillar considers factors such as examining diversity, equity and inclusion, labor management, data privacy and security, and community relations.

Governance

How are internal controls for decision-making and business operations structured? How is ethical, sustainable, transparent behavior governed, measured, and reported? The Governance pillar deals with a company’s leadership, audits, internal controls, board governance, business ethics, intellectual property protection, and shareholder rights.

Why ESG is so Important

As investors place an increasing amount of priority on ESG, lenders and rating agencies expect greater visibility of a broad range of non-financial metrics to better understand an organization’s social and environmental risks. Today, high ESG scores are emerging as a prerequisite for companies in attracting investor interest and funding.

ESG reporting is a form of financial and non-financial disclosures of the organization’s performance regarding its environmental, social, and governance impact through qualitative and quantitative measures. These report evaluate the risks, strategies, and opportunities that exist within ESG matters. ESG reporting is generally optional, but company disclosures have come under recent scrutiny with a Sarbanes Oxley, or SOX-like governance and control framework to provide assurances for ESG reporting and sustainability management controls.

There is increasing momentum to formalize and regulate ESG reporting, and certain aspects of ESG reporting have become mandatory in some countries. For example, ESG reporting will soon be required for select public interest companies in the European Union. Recent findings provide evidence that highly rated companies in terms of their Environmental, Social, and Governance (ESG) score report higher excess returns and lower volatility.

According to McKinsey research, successful ESG programs are tied to five core advantages:

- Higher top-line growth

-

Reduced costs

-

Minimized regulatory and legal interventions

-

Higher employee productivity

-

Optimized investment and capital expenditures

Most Companies Are Still Getting Started

ESG represents a complex set of challenges for most enterprises. Top management is under pressure to deliver on ESG objectives, but most companies are at the starting gate. According to the OCEG survey, only 46% of executives say they have a formal ESG program in place, and even fewer (43%) have established KPIs for ESG objectives. More than half (58%) of executives have little or no confidence in the reliability of their current ESG programs, according to a September 2021 survey by the corporate governance advocacy organization OCEG.

The relative experience of corporate boards is likely one reason for the slow pace of progress. Just 29% of Fortune 100 board directors have relevant ESG credentials, according to a report by NYU Stern Center for Sustainable Business.

How To Begin with an ESG Program

Businesses must consider different factors while deciding on ESG policies. First, you have to assess where the company stands when it comes to adopting ESG measures. Then, consider adopting the following ESG policies for your business:

- Determine the most critical areas on which to focus ESG for your business.

- Conduct an assessment among your investors, board, employees, and customers.

- Learn about different ESG standards, frameworks, and policies.

- Allocate resources and define strategies with accountability measures.

- Run ESG measures through different internal assessments to make sure it meets the required guidelines.

- Check your business’s industry-standard benchmark and become a signatory to relevant standards and reporting frameworks.

- Ensure your ESG strategy meets the required operating and governance model as stated by investors and existing compliance standards.

- Keep up to date with the changing regulations and needs of your stakeholders.

- Engage with other businesses, associations, regulators, and stakeholders to build collaborations and progress towards greater impact for shaping better ESG practices.

ESG Reporting Frameworks and Standards

Frameworks provide structure for measuring and communicating an organization’s ESG impact. Some frameworks are industry-specific while others can be applied to all sectors. The organization will need to determine which framework is best suited to its business. Various ESG reporting frameworks and standards have evolved to meet the needs of different stakeholders and industries including CDP, SASB, GRI, TCFD, (WEF) Stakeholder Capitalism Metrics, etc. While they are not (yet) mandatory, they provide a great lens for companies to demonstrate how they are contributing positively to global societal and environmental issues.

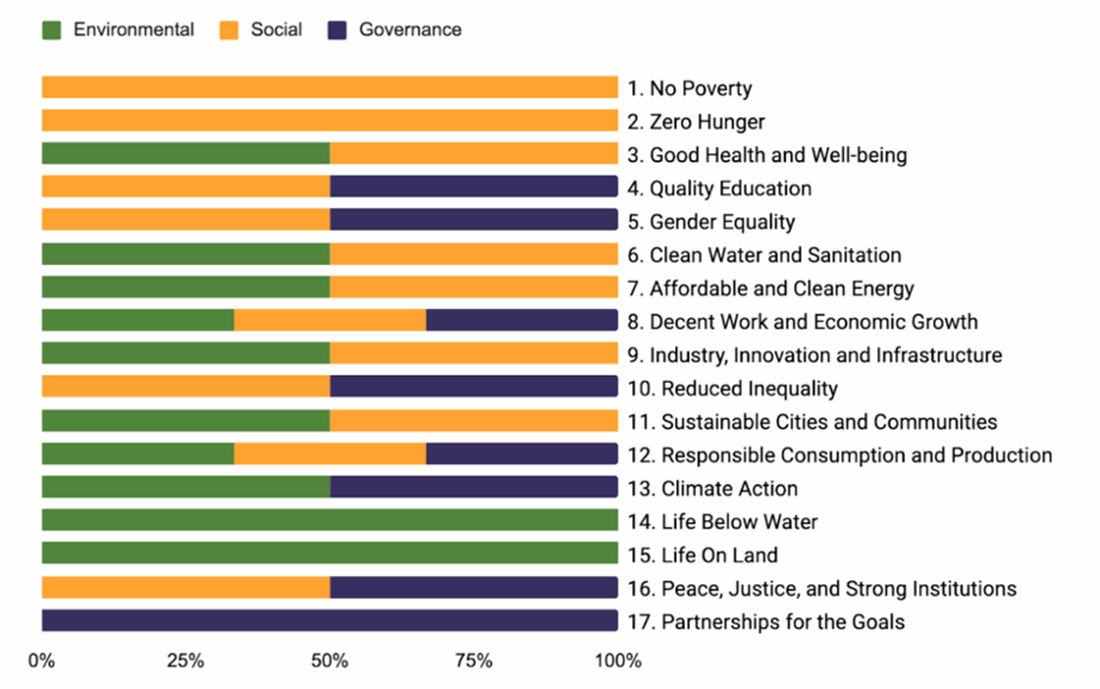

The United Nations Sustainable Development Goals (UN SDGs) is one framework companies may consider when establishing their ESG strategy. The UN Global Compact also provides a guide to help companies integrate the SDGs into their reporting that aligns with the UN Guiding Principles and the GRI standards.

The diagram below aligns the UN’s SGDs to the broad categories of ESG. The key to achieving the goals is linked to the targets and measures associated with each goal. These targets have been mapped to other initiatives and standards by SDG compass.